Making Cash Flow Forecasting for Manufacturers Easy

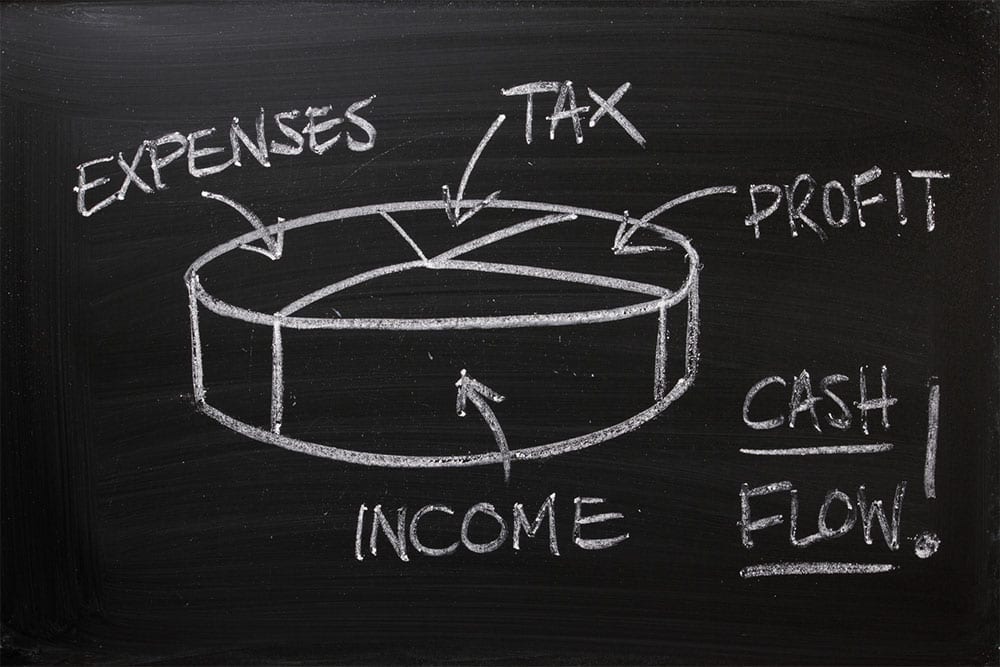

Without doubt, cash flow forecasting is a critical task that every manufacturer should undertake, especially in these current times. Often described as an early warning system, cash flow forecasting allows you to identify potential shortfalls in cash balances in advance and predict whether your business has sufficient funds to pay suppliers and employees.

With cash flow forecasting you can also spot problems with customer payments and see how quickly your customers are paying their invoices. Poor cash flow is generally the single largest reason for companies going out of business.

Yet cash flow forecasting continues to be neglected by many SMEs, possibly because it can be complex and takes time to manage. The good news is that E-Max ERP offers functionality to make cash flow forecasting for manufacturers a fast and easy process.

Integrated ERP automatically pulls the data from every department

Depending on the level of financial reporting a company is required to produce for its owners, cash flows can be complex documents tacked onto period end financial statements.

Typically produced in a spreadsheet, the data needs to be gathered from various departments across the company and manually entered. This can be a labour intensive activity, although if all employees strictly adhere to processes across the company, this can reduce the amount of time spent chasing the data.

Because E-Max ERP is an integrated ERP system that is used company-wide, there is no need to chase the data. The data required for a comprehensive cash flow forecast is already in the system so you don’t have to transfer data manually. As the data flows automatically into the cash flow statement, it is always accurate, up to date and can be viewed regularly on a daily, weekly or monthly basis. This enables you to react as necessary – whether that be through following up unpaid invoices or changing payment terms in future.

How E-Max ERP’s cash flow forecasting for manufacturers works

Income

Income in the cash flow forecast can be split out into three key areas:

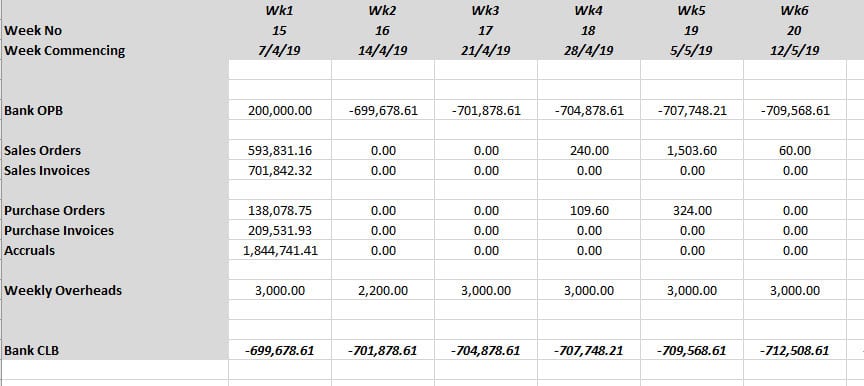

Sales Orders: The first element of the cash flow is expected income from confirmed sales orders. E-Max ERP automatically applies customer payment terms to the delivery dates of the order, allowing you to forecast the date the cash actually comes in. You can also allow for the payment of any sales tax or VAT involved with this order based on the invoice date, effectively producing a forecast VAT return

Sales Invoices: The next element of the cash flow is information from invoices already delivered, ie the balances on the sales ledger. As E-Max ERP includes a comprehensive accounts system, information on when cash is received, then posted into the ledger and allocated to the relevant invoice flows through to the cash flow forecast. It is thus easy to identify invoices outstanding and when they are paid.

Sales Opportunities: Where relevant, it is also possible to link the cash flow to opportunities that have been quoted. Provided your sales team keeps this data up to date and that the probable sales are identified consistently then it is also possible to add these figures to the cash flow, enabling an extended forecast.

Screenshot of E-Max ERP cash flow forecast – data is pulled in from other areas of the wider ERP system and provides a clear snapshot of your company’s cash position

Expenditure

Expenditure can be split into four key areas within the cash flow forecast:

Purchase Orders: E-Max ERP automatically links to the purchase orders outstanding and, by applying supplier credit terms, can calculate the date these purchases need to be paid.

Purchase Invoices: Like the sales side the system also links to the purchase ledger and hence can also account for the dates and values of invoices that need to be paid. On top of this the system also has access to purchase accruals (the total value of purchases received and not invoiced). Once again by applying supplier credit terms to these figures then it is possible to calculate exactly when these items will be paid. As regards the sales tax or VAT the system automatically calculates the net value that has to be paid even on items like sales orders which have not been invoiced.

Sales Quotes: E-Max ERP also factors in expenditure associated to sales opportunities or quotes. If the company records the expected expenditure on materials at the quote stage, it is possible to record the expected purchase costs involved in the sale.

Overheads: The final element in the cash flow is the overhead items like rent, rates, wages, etc. While we can link the system to the nominal ledger in case these figures are entered as budgets, most of the time the company maintains a weekly list manually. Depending on whether your company wants to include estimates of income not covered by the quotes or sales orders, then this can also be added in this section.

Saving time, resource and errors (and ultimately your business)

We’ve heard accountants say that taking the time to do a cash forecast each month is a whole lot cheaper than your business failing. Fortunately, as E-Max ERP integrates the key functions of Accounts, Quoting & Estimating, Sales Order Processing, Purchasing and Production Control into one system, all the information required to produce the cash flow forecast is readily available to you, making cash flow forecasting for manufacturers a whole lot easier. E-Max ERP’s approach gives your company a bespoke but instant statement of its cash position and saves significantly more time and resource (and errors) than a manual approach.

If you’d like to find out more about how E-Max ERP can help with cash flow fore-casting, then please contact us on 0808 109 2035 or drop us an email. We can also take you through a demonstration of the system so you can see how much easier cash flow forecasting becomes when it’s part of an integrated system.

If you’ve enjoyed this article, why not register to receive our monthly update on the latest industry and ERP trends?